Lifetime Cashflow Modelling

The financial planning industry has come a long way in recent years, with technology transforming the service and impact that holistic advisers can provide to their clients.

“If you don't have a dream, how are you going to make a dream come true”

OSCAR HAMMERSTEIN

Martin and Graham remember the era when review meetings were largely based on reporting that ‘your pension has grown by X% and your investment bond by X%’, followed by a discussion of whether a fund switch was warranted.

Financial planning is now more interesting and engaging for clients in a couple of ways. Firstly, many of our clients’ assets are held on online platforms, enabling them to view their own portfolios whenever they require, rather than waiting for a valuation to arrive. Secondly, lifetime cashflow modelling has transformed the financial planning process for forward-looking advisers.

We believe that the truth about money is not ‘what percentage has that fund grown by?’, but that money is there to support someone’s lifestyle, as life is not a dress rehearsal. We encourage our clients to imagine how their lives would evolve in an ideal scenario, and then build and tailor financial plans around this desired journey. This can be very different for each individual client. For example, some clients may be motivated to maximise the estate that they leave to children. Other clients may want to tick off a ‘bucket list’ and simply want reassurance that their wealth will be sufficient for life. We are not here to try to stop people spending money – our duty is to help people make informed and sustainable decisions.

Cashflow modelling software enables different financial and life decisions to be easily compared – eg the difference between retiring at 60 and 65, different levels of spending in retirement, or the potential impact of care fees.

Please let us know if you want to explore and discover what may be possible for you.

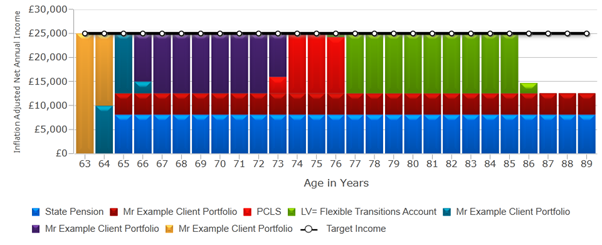

Retirement Income Chart

This chart below shows the estimated yearly income someone will receive from their pension, savings and investment plans. All income shown is the net amount received after tax, and values have been adjusted to reflect inflation at an annual rate of 2.50%.

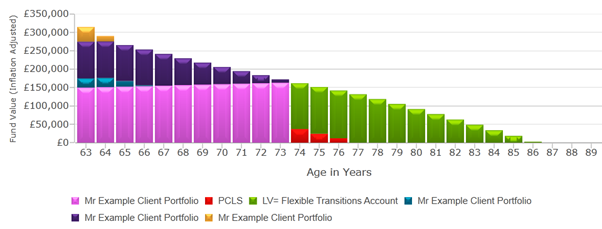

Yearly Asset Value Chart

This chart shows the value of each of the assets included in the projection in retirement. Again, values have been adjusted to reflect inflation at an annual rate of 2.50%.

So, in this example, their money would run out at age 85. This is really the starting point for further discussions. What if inflation, investment returns or interest rates are higher or lower than assumed? Are they expecting an inheritance or planning to downsize, which will inject capital into the plan? Or conversely, are they planning to help children or grandchildren during their lifetime or have any other projected items of capital expenditure? All these scenarios can be easily compared and contrasted using the software.

INVESTMENT MANGEMENT

Naturally, clients look to us to deliver superior returns than they would expect to achieve themselves. Some clients have no experience in this area, while others have high levels of knowledge, but lack the time to manage their own portfolio, or value additional input into their wealth management. Either way, we enjoy the education process, and raising understanding of the principles of investing.

Allied to this, our ongoing ‘Partnership’ service provides quarterly reports on investment conditions and outlooks, as well as other topical or relevant financial planning issues.

Rather than creating an additional layer of charges for our clients, we make all investment decisions in-house, and do not outsource this to stockbrokers or other third parties unless a client has a preference to do so. Using the vast array of information available to us through our subscription to research systems, accrued historical data, attendance at seminars and direct access to investment managers, we design and monitor various portfolios (tailored to specific client risk levels and client objectives).

While in an ideal world we all covet ‘maximum reward with minimum risk’, in reality we know that risk and reward are related. Notwithstanding this, and regardless of risk profile, we strive to achieve the most consistent long-term return possible. Controlling fluctuations is as important as returns for many of our clients.

Our in-house investment committee of advisers and technical personnel meets quarterly to review our portfolios. The most important factor determining returns is the asset allocation – the split between equities (stocks and shares) and more stable investments such as gilts. Beyond that, we diversify the portfolio within each sector – eg UK and overseas equities, government bonds and corporate bonds. Finally, within each sector, we choose accordingly for the client – eg for someone in retirement, UK equity income funds with reliable dividend streams are preferable to smaller company growth funds.

In addition to the investment return, there are other areas where we can deliver positive outcomes for clients, such as the following:

- Using ISA allowances

- Structuring portfolios to make use of other tax allowances, such as the Income Tax personal allowance and the Capital Gains Tax annual exemption.

- Apportioning ownership of investments between spouses in the most tax-efficient way.

- Where appropriate, having regard for Inheritance Tax-efficient investments.

- Tax-efficient National Savings products.

- Our ongoing review service provides the opportunity for discussions such as profit-taking.

The continuing low interest rate climate has led to many people considering active investment for the first time. Some people have reservations about this, through personal experience or anecdote. We aim to provide a reassuring feel of behavioural coaching alongside the nuts and bolts of our investment expertise. £60 billion per year continues to be deposited in Cash ISAs. We welcome enquiries for those who feel they hold surplus cash and are keen for their assets to maintain or improve their real value.

Ethical Investing

We have clients who have specified that they do not want an unfettered investment strategy, as it is important to them to exclude certain sectors from their portfolio. For example, tobacco stocks are commonly among the top ten holdings in UK equity funds, while other clients may want screening of their portfolio on environmental grounds.

Ethical investing has developed hugely in the past 20 years, and there are now a vast array of funds to suit preferences, which form part of our due diligence and panel of preferred funds. It is also interesting to note that ethical investing no longer carries an inevitable penalty in terms of returns – it certainly can sometimes be the case that ethical funds out-perform unconstrained counterparts.

LATER LIFE PLANNING (LONG-TERM CARE)

One of our IFAs, Graham Tracey, is an accredited member of The Society of Later Life Advisers (SOLLA) – one of the few in the North West to hold this specialist position.

“One man in his time plays many parts, his acts being seven ages”

WILLIAM SHAKESPEARE

Through his involvement with SOLLA, Graham is an acknowledged expert in long-term care fees planning advice, having won a national award from the care fees organisation Symponia for the quality of his reports in 2014. We are keen to share this expertise with any one who has friends or family members who may be facing the prospect of paying for their care.

Families can easily feel overwhelmed by the task of wading through the mass of information and regulations at what is inevitably a stressful and emotional time when a loved one requires care. Graham’s aim is to act as a trusted adviser, providing a central point of information and specific advice, as well as liaising with or introducing a solicitor or other professionals to create an over-arching solution. He is also trained as a Dementia Friends Champion, reflecting an appreciation of the sensitivities required when helping elderly or vulnerable people.

The process through which Graham takes families is to help them explore the options for care and the environment that the individual would prefer – this may be domiciliary (at home) or residential/nursing. Once the shortfall between care costs and a person’s income is calculated, strategies for meeting this shortfall and ensuring that this is sustainable for life (however long this may be) are explored. These could be a combination of drawing down on capital, considering options for the house (like equity release or a deferred payments agreement), investing for income (within a cautious risk strategy), and immediate needs annuities (which can only be advised on by a specialist adviser like Graham).

The £72,000 cap on care costs under the Health and Social Care Act has now been shelved (probably indefinitely), but in any event had been widely misinterpreted by sections of the media, and it was never the case that the authorities would pick up the tab once this amount had been spent

The impact on the eventual value of an estate, as well as the quality of care throughout later life, may be massively improved by seeking timely expert independent advice.With advance planning, the twin goals of providing the best quality and preferred care for life, while still leaving a legacy, need not be mutually exclusive.

Financial Protection

A wise person is one who is prepared.

“Life is what happens when you are busy making other plans.”

JOHN LENNON

It’s all very well thinking about the nicer aspects of watching your investments grow and planning for a good retirement, but what if something happens to you or a loved one unexpectedly?

A wise person is one who is prepared just in case things go awry through serious illness or even premature death.

Ask yourself what would happen if such an event were to arise, here are some examples:-

Young and just starting out

- Could you afford to take time off work to recover from illness?

- How would you continue to pay your mortgage, rent or bills?

- Would your debts start to become overwhelming?

- Would you be forced to spend your hard-earned savings?

Expecting a baby

- Would your mortgage quickly become too much for the family?

- Would you need additional or full-time childcare?

- You may have savings, but how long would they last?

- Could you still afford your credit card or loan repayments?

- Could you deal with the financial worries?

Found your dream home

- How long would it be before you got behind with your mortgage?

- How quickly would your debts build up?

- How quickly would your savings disappear?

- Might you be forced to sell the property at a loss? Property doesn’t always go up!

- If your partner was left on their own, how would they cope financially?

Sole parent

- Who would look after your child or children whilst you recovered from an illness?

- Would you be able to afford additional child care?

- How long would it be before the family home became vulnerable?

- How would the loss of income affect your children’s lifestyle?

- If the worst happened how would you leave money to provide for your children?

Because raising a family costs more than you expect

- Would you be able to keep the roof over your head?

- Would your family be able to maintain its lifestyle?

- If you had to downsize, would your children be able to remain at their school?

- If one of you became seriously ill, would the other be able to work and still do the school run?

- If you needed extra childcare and care for one of you, how would you pay for it?

Want to leave a lump sum to your family?

- Could your partner manage in later life without you?

- How would not being able to work due to ill health affect your retirement plans?

And at the end of your life…

- Would you have enough set aside to pay for your funeral costs?

- Would you be able to leave a gift for your grandchildren?

Corporate Protection

It’s often acknowledged by business owners that their employees are their biggest asset – after all, these are the people that contribute so much to business profitability.

“I never worry about action, but only about inaction.”

WINSTON CHURCHILL

Having got the right people in place, a firm wouldn’t want to lose their key skills through long periods of forced absence necessitated through illness; nor would they want to feel vulnerable if a key employee were to suddenly die. Should such an event occur, a firm’s contingency strategy may include having some insurance protection in place to protect its financial position.

As well as protecting the business, a firm may also want to offer some benefit to its employees and their families when they become ill, or worse still, die whilst in service.

What can a business owner put in place?

Protecting the financial security of the business

Key Person Insurance- this is suitable where (often senior) employees, who are crucial to the profitability of the firm, die or are unable to work through long periods of ill health. An insurance policy pays a lump sum to the firm which can be used to help the business get back on its feet.

Protecting the shareholders

Shareholder Protection Insurance- this is recommended where a shareholder wishes to protect their position if a fellow shareholder were to die or suffers a serious illness.

A surviving shareholder may be worried that control of the business would be lost if the shares of the deceased were to be sold to an unwelcome party. An insurance policy, along with a prepared legal document arranged by a solicitor, would allow the remaining shareholders to decide if they wish to buy the shares, which then enables continuity of control.

Protecting employees – and their families

- Life cover– simple to arrange, a firm may want to offer all or some of their employees membership of a company Life Assurance Scheme. Here, should an employee die, a sum of money is paid for the benefit of his or her next of kin.

- Income Protection– an insurance scheme could be put in place for all or some or their employees whereby the majority of their income would be paid out if the employee could not work after a period of sustained illness or disability.

- Private Medical Insurance– the availability of an employee quickly receiving hospital treatment at a chosen hospital means that an employer could expect to see him or her return to work sooner than otherwise where treatment waiting times may be longer with the NHS. The employee also benefits with prompt attention at a time and location to suit their preference.

Whatever your priorities are, your independent financial advisers at Backhouse will find you the right solution for your needs.

YOUNGER CLIENTS

It is a sober thought for many of us that The Society of Later Life Advisers class ‘later life advice’ as anything relating to over-55s, so without bracketing our clients above that modest age as old, we could by the same token happily describe those in their early 50s or less as younger!

This is arguably a time of unprecedented strain on this generation. In some cases, people find themselves ‘in the sandwich’, simultaneously caring for elderly parents while still having financial responsibility for their own children, who may still live at home. All this is in an era when final salary pension schemes are a rarity, and the growing ranks of the self-employed have by definition no employee benefits package.

The areas we are likely to address with our clients at this stage of life include the following:

- Protection – to repay a mortgage, to provide for lost income in the event of death or serious illness, income protection should illness or injury prevent working, Private Medical Insurance.

- Pension trajectory – what retirement age and standing of living is a realistic proposition?

- Guidance on helping children onto the property ladder or with their own fledgling financial planning.

- Care fees planning for parents (including Inheritance Tax mitigation if relevant).

Why Use An IFA?

When we first meet a potential client, we are struck by the wide range of reasons that have prompted the contact. Some people may have had experience of professional advice before, whereas for others they may be seeking advice for the first time, and may harbour some apprehensions: for example ‘Is it complicated?’, ‘Where do I start?’, ‘What will it cost?’, ‘Can I trust them?’ For this reason the first comment we make is that we provide regulated advice, and everyone we advise enjoys the protections of the Financial Conduct Authority and Financial Ombudsman Service.

Another remark that we sometimes hear from ideal potential clients is that “I know I wouldn’t be a big or important client for you”. This tendency to under-estimate the value of wealth, or to suspect that we only act for clients with assets over the million pound mark, does not reflect the diversity of our business. We are keen to hear from anyone whose current or future situation could be improved from expert advice.

The following points give a flavour of some of the reasons why we are engaged by clients:

- Considering a life- changing decision such as early retirement or a career change.

- Ongoing management of wealth to seek returns higher than savings rates or inflation

- Specific advice on aspects of pensions such as taking benefits, or transfer or consolidation exercises.

- Family issues – caring for parents or helping children; minimising inheritance tax on death so the family not the taxman is the beneficiary.

- Some people possess the knowledge but not the time to manage their financial planning.

- Desire for a more personal and structured service than provided by a current or previous adviser.

EMPLOYEE BENEFITS

We frequently see the link over time between valuable employee benefits and success in attracting and retaining employees at all levels. Whether the benefit is a legal requirement or implemented voluntarily, we work with employers to ensure that the arrangements are cost-effective, and staff understand their value.

Workplace Pension Schemes

Most companies have now passed their staging date under the Auto Enrolment legislation and have a pension scheme in place. This is not an end to an employer's obligations, as schemes must be re-certified every 3 years, and we are consulted to review the ongoing suitability and values of schemes. In some cases, employers also appoint us to provide presentations or one-to-one surgeries with their workforce. The feedback from staff to management is always that they find these sessions extremely useful, as it helps them plan for their own retirement, encouraging them to keep the employer informed about their intentions, and to remain with the company until such time.

Group Protection Schemes

While thankfully rare, early death or serious illness does occur, and this can have a profound affect on the workforce, as well as of course on the deceased's family. Group Death in Service, Critical Illness or Income Protection schemes may not be as expensive as thought. Benefits can be structured according to the level of employee - eg 4 x salary for management and 2 x salary for other staff. We are happy to provide indicative costings on confidential receipt of employee data.

A surviving shareholder may be worried that control of the business would be lost if the shares of the deceased were to be sold to an unwelcome party. An insurance policy, along with a prepared legal document arranged by a solicitor, would allow the remaining shareholders to decide if they wish to buy the shares, which then enables continuity of control.

Private Medical Insurance

Company schemes can be established for key employees, who may also include family members at their own expense. Premiums are treated as a benefit in kind. With NHS waiting times growing, private medical cover can also be seen as a benefit for the employer as well as the employee, reducing time that may otherwise be needed away from the workplace.

BEYOND RETIREMENT

In many senses, there is much to look forward to for the Baby Boomer generation who are retiring now. Increased longevity, and the extension of good health until later ages, provides greater opportunity for travel, holidays, leisure pursuits and hobbies than ever before. Levels of wealth have also risen, not least through the dramatic rise in property values over past decades, which may make achieving desired lifestyles possible.

However, these opportunities often come hand in hand with financial threats, as many of the old certainties wane. Final salary pensions with their guaranteed benefit levels have proved unaffordable for most employers, leaving millions of people reliant on building personal pension plans to generate benefits. Savers can no longer count on interest rates of 5% or more. Rising property prices may have benefitted those at retirement age, but their children may be struggling to get on the ladder, and may also have suffered work-wise from the recession. Many parents therefore feel the need to help their children financially during their own lifetime. Finally, the flipside of living longer is the possibility of long-term care in some form or another, together with its substantial cost and the ongoing emphasis on individuals to pay for their own care.

We offer a personalised review for people approaching or at the point of retirement. The sharpest focus of this is often on the various pension options and their relative merits:

- We offer a personalised review for people approaching or at the point of retirement. The sharpest focus of this is often on the various pension options and their relative merits:

- What are the tax and investment implications?

- How important are death benefits?

- Would a full or partial annuity still be prudent, particularly if enhanced rates apply.

- Savings and investments in retirement – capital preservation or income generation

- Helping children

- Private medical insurance

- Care fees planning

- Inheritance tax planning

- Options for the house

- Wills and Lasting Powers of Attorney

PENSION CONSOLIDATION

We are often contacted by people seeking a greater understanding and harmony of their pension benefits. Through changes in employment, they may have several different pension schemes, and are often unsure of values, charges and investment strategies..

There are frequently advantages to be had from consolidating various ‘defined contribution’ benefits under a single plan:

- A headline value of a single overall amount, making forecasting for retirement easier.

- The opportunity to monitor this value online through the portal of the recommended provider.

- An integrated investment strategy based on funds from the entire market, not just those available under existing providers’ ranges.

- Ability to utilise Flexi-Access Drawdown if not available under existing plans.

- Availability of Beneficiary Drawdown, if passing down family wealth in pension form is important from an Inheritance Tax perspective.

- As a vehicle for future contributions.

However, such an exercise should never be undertaken blindly. It is crucial that any factors that may favour leaving certain benefits in situ are explored, such as:

- Guaranteed Annuity Rates or other guaranteed features

- Excessive transfer penalties or Market Value Reduction (MVR) charges

- Some former employer schemes may have favourable annual management charges

Whatever the recommended outcome, undertaking this exercise (particularly where total pension assets are £75k or more) is extremely useful in appreciating where you are in relation to where you want or need to be. It may be possible to turn the various strange fruits into a satisfying smoothie!

THINKING OF RETIRING, TRANSITIONING OR CHANGING CAREER?

There is a saying for people now in middle age that “my Dad had one job in his life; I’ll have 6 jobs in my life; my children will have 6 jobs at the same time”. Working patterns are changing, and the days of a linear career with a single employer are all but gone, through circumstance or choice.

The work that gives us the most satisfaction often involves helping people with the financial transitions involved in a major life change. There is no greater professional feeling than when a client tells us their life is better than it used to be. This interest arose from a period when Martin and Graham were involved in providing financial reviews and counselling to long-serving employees of blue chip companies facing redundancy. The different ways in which people viewed the change and hoped to take their working lives forward was fascinating, surprising and often positive.

We also have experience of helping people who are undergoing changes in their personal life, particularly having worked closely with family solicitors on the financial aspects of separation or divorce.

The most common age bracket for people starting their own ventures is now in their 50s – so-called ‘olderpreneurs’. The stresses of professions like teaching or corporate life (among others) lead many people to seek a second career (or even a ‘portfolio’ career of different roles) where they feel more in control of their destiny and work-life balance. We have helped many people who enjoy what they do, but prefer the freedom of consultancy rather than the confines of the corporate environment.

Regardless of how much personal or professional change may be a step into the unknown emotionally, psychologically and intellectually, a financial review is an important element of the journey. We use the lifetime cashflow system shown elsewhere on this site to help people understand what their long-term financial future may look like in different scenarios.

We also help them address specific issues such as how their pension benefits could be flexibly accessed to dovetail with reduced working commitments, and whether financial protection arrangements (such as life assurance and healthcare) are needed to replace lost elements of an employee benefits package.

DEFINED BENEFIT / FINAL SALARY PENSION SCHEMES

We possess the specialist qualifications required to advise in this area, and have seen an upturn in enquiries about transferring out of such schemes over the past year or so. This has been prompted by several factors:

- Rising Cash Equivalent Transfer Values (CETVs) due to low gilt yields.

- The ‘Pensions Freedom’ regulation enabling benefits to be taken more flexibly from individual plans, and often at earlier ages.

- The improved tax treatment of death benefits under individual plans.

The improved tax treatment of death benefits under individual plans.

This is a highly regulated area, as despite the high examination threshold for IFAs advising on DB transfers, the Financial Conduct Authority is rightly concerned about the severe impact of wrong decision-making on client’s lives. For this reason, we do not act on an ‘insistent client’ basis by signing declarations for scheme administrators should we feel that a transfer would not be in someone’s best interest.

While we welcome enquiries in this area, as it forms part of the holistic service we offer, we operate a specific fee structure for the advice process. This is a reflection of our specialist qualifications, and the necessary due diligence considerations of detailed analysis of being active in this field of advice.

- Stage One: Initial meeting where the potential client brings a current CETV and preserved benefit statement. By the end of this meeting, we will be able to indicate whether we feel that transferring benefits may be provisionally suitable, or whether remaining as a member of the scheme is clearly the right course of action.

- Stage Two: Detailed report including the mandatory requirement of a TVAS (Transfer Value Analysis Service) calculation of the critical yield. The report also considers all other relevant factors that should be taken into account in considering transferring. It also provides investment recommendations for the transfer payment within an individual vehicle.

As part of the above to Advice, we also sign the Regulated Advice Declarations required for proposed transfers of over £30,000. We prefer to work on an ongoing basis with clients transferring out of defined benefit schemes, in order to ensure continuing positive outcomes from what should be seen as one of the biggest financial decisions taken in life.

BUSINESS OWNERS

Through our relationship with our sister company Backhouse Insurance Brokers, we have extensive experience in working with business owners, both during their tenure in the business, and following exit. This involvement can cover a wide range of areas, all of which may make a substantial difference at various stages.

Self-Invested Pension Schemes and Family Pension Funds

Self-Invested Personal Pensions (SIPPs) are often used to purchase and own business premises, with the business then paying rent into the SIPP. Business premises can also be owned by a Small Self-Administered Scheme (SSAS), which has the additional feature of being able to make loans to the sponsoring employer. Both types of vehicle are useful in enabling money to be extracted from the company without corporation tax by way of company pension contributions.

Where a business is family owned, family pension schemes can be an ideal way of facilitating a smooth transition into retirement for the elder generation, by enabling them to draw an income from the fund, while the company can still make contributions for the future benefit of the younger generation taking the reins.

Exit Planning

Where a business is to be sold to a third party, we are on hand at every stage of the process. Lifetime cashflow planning helps us to quantify the sale price required, and we liaise with accountants on relevant issues such as Entreprenuers Relief. We act for many former business owners who are now happily retired, and who engage us to help them draw a sustainable and tax-efficient income from the proceeds.

Keyperson Cover and Shareholder Protection

We also help to put life assurance (and critical illness) arrangements in place to protect businesses and their owners. Keyperson cover serves to protect the trading position of a company in the event of the death or serious illness of a senior figure, whose absence would in some way affect its future success.

Shareholder protection arrangements are used to generate funds that can be used to buy out the shareholding of a deceased owner, ensuring that this is not sold to a third party who may destabilise the business.

PROFESSIONAL CONNECTIONS

Given our combined decades of experience, we have built up a sizeable network of fellow professionals who have helped our clients, as well as on occasion ourselves personally. Just as many of our referrals are through word of mouth by existing clients, so are we happy to refer clients to professionals in other areas in whom we have full confidence that they serve you well.

- Solicitors - variously advising on Wills, Lasting Powers of Attorney, Property Trusts, conveyancing, employment law and commercial law

- Accountants - on both personal and corporate tax planning

- Independent Mortgage and Equity Release advisers

These include the following:

FEE STRUCTURE

We welcomed the implementation of the Financial Conduct Authority's 'Retail Distribution Review' in 2013, as we believe our charges should reflect transparency and fair value.

Initial fees, either for transactional work, holistic advice or implementation of recommendations, will usually be quoted on a fixed fee basis. This will reflect the complexity of the advice and the time involved and by which employee positon this will be undertaken by.

For ongoing advice, we offer our Partnership service, which is ordinarily charged at 0.85% per annum of the value of assets under management. In return, clients currently receive two meetings each year, as well as quarterly valuation statements and our accompanying commentary and recommendations. In most cases, clients have 24/7 access to their portfolios online, as well as unlimited telephone and email support with our team.

Foundation fee

We also offer a less extensive Foundation service charged at 0.55% per annum.